The wait is over; Philadelphia property owners can now search and pay their property tax bills on the City’s new tax website: the Philadelphia Tax Center. This site is the quickest and most convenient way to look up and pay Philadelphia Real Estate Tax. It is mobile and tablet-friendly and accessible in Spanish.

The Philadelphia Tax Center lets you:

- See past balances, going as far back as 2010.

- “Make a payment” after searching your property. This feature allows you to pay your balance in full or by period.

- Access and manage multiple property accounts from a single dashboard. This is ideal for owners or individuals managing multiple property tax accounts. You must first create a username and password to take full advantage of this self-service feature.

The 2023 Real Estate Tax bills will become available on December 1. You can expect to receive yours in the mail throughout the following week. Next year’s bills are due March 31, but you don’t have to wait for the deadline to pay. When you receive yours, you should go directly to the Philadelphia Tax Center to search for and pay your bill. The property balance search website you previously used will redirect your searches to the Philadelphia Tax Center from now on. While you can still search your property on the phila.gov website, the “View the Tax Balance” link will reroute your searches to the Philadelphia Tax Center.

No username and password needed

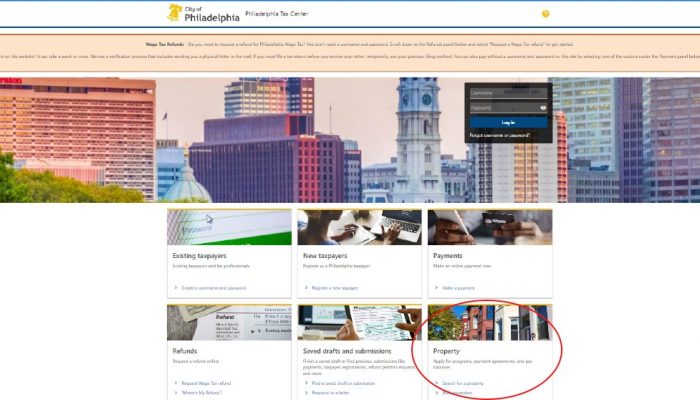

You will need your street address or 9-digit OPA number to access your property on the new website. A username and password aren’t required to look up and pay your bills online. Here’s how to search and pay:

- Go to tax-services.phila.gov.

- Pick “Search for a property” under the “Property” panel.

- Enter your street address on the “Search for a property” screen and hit “Search.” Your property’s OPA number will appear in blue on the right side of this same screen. Select it and proceed to the next screen, where you can view a summary of your property account. Here, you can “Make a payment,” “View period balance,” “Apply for real estate assistance programs,” and “View liens and debt.”

You can also use the “Property” panel to see and pay all balances on a property at once or by period. This feature also lets you pay associated fees, such as any Commercial Trash Fees or License & Inspection (L&I) Abatement invoices pending on your property account.

Another way to pay your bills online is by selecting “Make a payment” under the “Payments” panel from the Philadelphia Tax Center’s homepage. Click “Yes” to pay a current year’s bill. If you are paying past due bills: Choose “No” on this screen and use the dropdown menu to select “Real Estate Tax.” Using the Letter ID found at the top of your bill makes paying online easier.

Follow the onscreen directions to complete your payment. If you need help or have questions, please call (215) 686-6442.