The City of Philadelphia is again allowing employers to submit Wage Tax refund requests on behalf of their employees—just like in 2020. Employers can now use our downloadable bulk form to submit their petitions online.

You can access the 2021 form from our website. Please use it to request refunds for employees who were mandated to work outside Philadelphia due to the pandemic. The form is designed to capture more information this year, including an employee’s personal and tax information. But don’t worry; it will guide and help you capture the details we need to process your petitions.

Don’t use the bulk form for employees with severance, bonus pay, or stock options. Such employees must submit a longer individual Wage Tax refund form through the Philadelphia Tax Center.

Before you start

Employers should submit W-2 forms for qualifying employees through the Philadelphia Tax Center before submitting a bulk request.

You will need the following details about each employee to fill out the bulk request form:

- Full name,

- Social Security Number,

- Current address,

- Days worked outside Philadelphia,

- Wage Tax withheld per W-2, among others.

Once you’ve gathered everything, please download the employer-requested bulk form and complete it.

Submit online

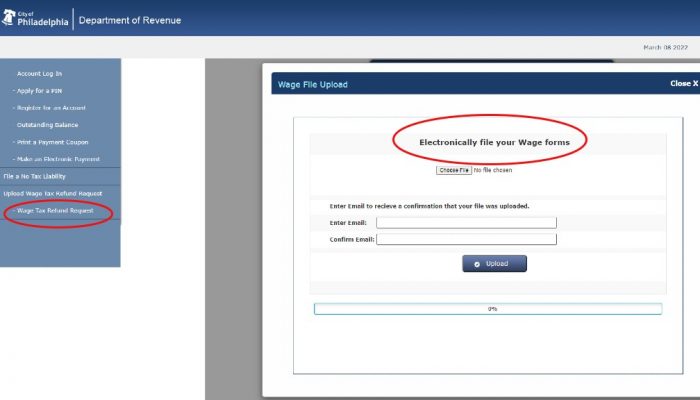

Do not email the bulk request form—it contains sensitive information. The only way you should submit it to the City is online, through our eFile/ePay website. The process is easy; you don’t need a username and password:

- Go to https://ework.phila.gov/revenue/

- Scroll down the left-hand menu,

- Pick “Wage Tax Refund Request.”

- On the “Wage File Upload” screen, select the “Not sure how to proceed?” link for guidance on submitting your documents.

The site will prompt you to “Electronically file your Wage forms.” Follow the on-screen prompts to complete the process. Remember, there is no paper form for employer-requested refund petitions. You must submit them online to ensure fewer errors and faster processing.

After you submit

We will send you a confirmation email. Please allow six to ten weeks for processing.

If an employer doesn’t submit a bulk request on an employee’s behalf, the employee may submit a request through the Philadelphia Tax Center. You can access the online forms from the Tax Center’s homepage—no need for a username and password. The process is fast, easy, and secure.

If you have refund-related inquiries, please call (215) 686-6574. You can also email refund.unit@phila.gov for help.