Philadelphia’s Wage Tax is a tax on salaries, wages, commissions, and other compensation. You must pay this tax if you are:

- A Philadelphia resident, regardless of where you work, or

- A non-resident who works in Philadelphia.

Your employer should withhold and remit the Wage Tax to the City on your behalf. You must file and pay this tax for yourself if your employer doesn’t collect and pay it for you.

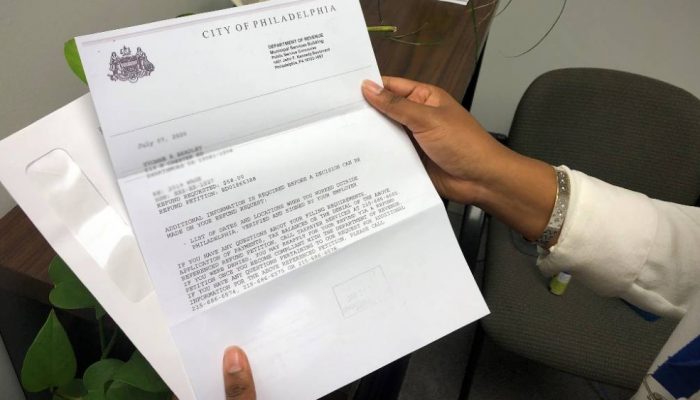

In certain instances, some taxpayers can claim a refund by petitioning the City. But you must submit the appropriate form, along with other required documents.

The Department of Revenue is currently working through thousands of Wage Tax refund requests, mostly from employees required by their employers to work remotely due to COVID. The good news is that we have approved over 30,000 petitions received thus far. But we have also denied a portion of requests for various reasons. Read the following frequently asked questions to help you understand some of the common reasons why a Wage Tax refund request may be denied:

Why is my refund petition denied?

We encourage you to review the brief explanation provided in the letter we send you. The denial reason is usually explained in that letter. But here are the top four or most common reasons we reject refund requests:

- Failure to provide a W-2 – without a W-2, we can’t calculate your refund. Your W-2 helps us verify your Social Security Number, your employer’s Federal Identification Number, your compensations, and the tax you pay to Philadelphia.

- Failure to provide a list of dates and locations – If your employer requires you to work remotely or travel, you must provide us with a list of dates and places where you worked. This helps us verify the dates and locations your employer ordered you to work outside Philadelphia. We recommend using this template to help you capture all the details required to process your petition. Submit this template together with the Wage Tax refund request form.

- Missing signatures – keep in mind that refund petitions are legal documents that require signatures of both employers and employees. We cannot process a partially signed or an unsigned request. With the non-resident COVID – EZ refund petition, we need your signature on the petition, and either your employer’s signature or a letter addressed to you, verifying the time worked outside of Philadelphia. Your employer must sign the letter and have it on company letterhead with the dates and times you had to work from home due to COVID-19.

- Submitting the wrong form – It is important to carefully read each form before submitting your requests. You cannot simply use the COVID – EZ form in place of the longer paper form in every case. The COVID – EZ form is for COVID remote work only. It is an easier and quicker petition to complete. But it is only meant for non-resident employees who work a normal, full-business day in Philadelphia but had to work outside the city during the pandemic. Do not use this form for your overtime, travel, business expenses, or stock options. Instead, use the longer paper form to capture all these. Also, if your days worked outside the city are higher than the COVID remote days, please do a longer form. Remember, submitting the wrong form means we will deny your refund.

It’s been more than 10 weeks; how do I check on my refund?

Speak with a member of our Refund Unit about your request by calling:

- 215) 686-6574

- (215) 686-6575

- (215) 686-6578

Often, we can answer your questions or resolve your issues over the phone.

I never received a check; how do I request a new one?

The first step is to email refund.unit@phila.gov. This allows us to verify if a check was issued. We will involve the Treasury Department to confirm status of the check.

If you didn’t get your check due to incorrect information, such as a wrong address, you must complete a certification form with the Treasury Department for a new check to be issued. It takes two to three weeks for a new check to be issued.

In certain situations, the Refund Unit works directly with the Treasury Department to stop payment on the lost check and issue a new one to the petitioner.

My employer submitted incorrect information for my Wage Tax refund; how do I correct this?

You cannot contact us directly in this case. Your employer should contact us and provide us with more information, such as a W-2 form.