Good news for Philadelphia Wage Tax payers: you can now complete your 2021 refund requests electronically! Just go to the Philadelphia Tax Center to easily submit your request. You can access the online forms directly from the Tax Center’s homepage—you don’t need a username and password. The process is fast and secure. Our online system is also accessible on mobile devices and available in Spanish.

Philly’s Wage Tax is a tax on salaries, wages, commissions, and other compensation. Your employer withholds and remits this tax to the City on your behalf.

To qualify for a refund, you must be a:

- Non-resident salaried or hourly employee required to work outside the City due to COVID-19,

- Commissioned or salaried employee with stock options and/ or business expenses,

- Low-income taxpayer who qualifies for Pennsylvania tax forgiveness, or

- Philly resident who paid taxes to another jurisdiction.

Here’s what you will need to apply:

Salaried or hourly employees will need their W-2s and a letter from their employer to accompany their refund requests. The letter must be signed and on company letterhead. It must also specify all dates and locations you worked outside Philadelphia. If claiming a refund for a partial year, the letter must explain this.

If requesting a refund for business expenses, you must first file PA Schedule UE with the Commonwealth and attach this form to your Philly refund petition.

Income-based petitioners will need their W-2s and copies of their A-40 Personal Income Tax Return and PA Schedule SP. You must file these with the Commonwealth and upload copies to your refund request. We can’t process your request without these PA forms.

Submit online

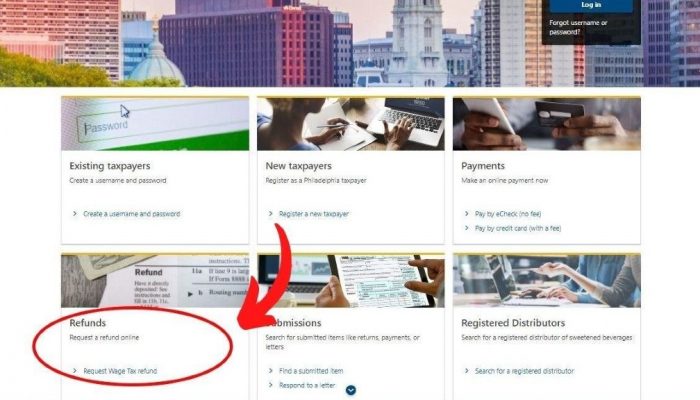

Once you’ve gathered everything you need: Go to https://tax-services.phila.gov, scroll down to the “Refunds” panel on the homepage, and select “Request Wage Tax refund.”

Select the refund type that applies to you on the “Tax filing information” screen. For example, low-income refund applicants must choose “I am qualified for the income-based PA tax forgiveness rate” from the menu. Make sure to select the correct year for which you are requesting a refund.

The website will prompt non-resident petitioners to download and complete an Excel spreadsheet. Use this template to capture your details accurately. Once completed, select “Add attachments” to easily upload your spreadsheet to the Philadelphia Tax Center.

Before you submit

To successfully claim a Philadelphia Wage Tax refund, you must submit the appropriate form. Make sure to carefully read each form before submitting your petition.

For example, you cannot use the COVID-EZ form in place of the longer form in every case. The COVID–EZ form is for COVID remote work only. This form is meant for non-residents who had to work outside the City due to the pandemic.

Don’t use the COVID-EZ form if you had overtime, severance pay, travel, business expenses, or stock options. Instead, use the regular online salaried form to capture all these. Also, if your days worked outside the City are higher than the COVID remote days, please use the regular form.

Although paper versions of the 2021 online Wage Tax petitions are available, we encourage you to use the online form. This will ensure fewer errors and faster processing.

If you have trouble requesting a Wage Tax refund on the Philadelphia Tax Center, please call (215) 686-6600. For refund-related inquiries, please call (215) 686-6574, 6575, or 6578. You can also email refund.unit@phila.gov for help or answers to your questions.