Are you a Philly Wage Tax payer who needs to request a refund? The Philadelphia Tax Center is where you can easily, quickly, and securely make this request online without a wait. The best part? You don’t need a login to request a Wage Tax refund electronically! In this blog, we walk you through the steps of requesting Wage Tax refunds and payment agreements on our new tax filing and payment website.

Here’s how to get started with your electronic Wage Tax refund request:

- Go to https://tax-services.phila.gov/_/,

- Select “Request Wage Tax refund” under the “Refunds” panel on the home screen,

- Make sure to read the brief instruction and enter your information, including your mailing address. It’s very important that we have your correct address on file.

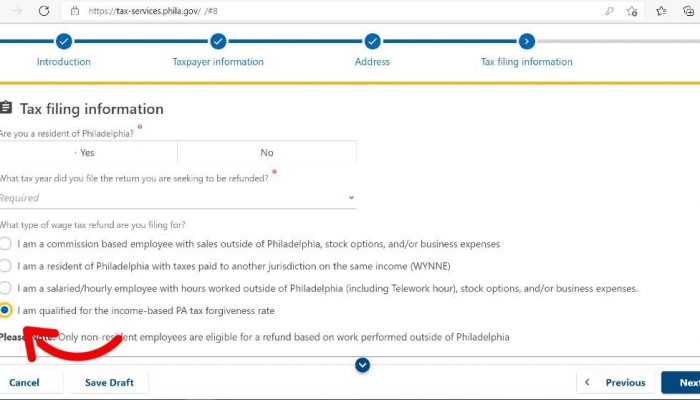

On the “Tax filing information” screen, pick the refund type that applies to you. For example, low-income refund petitioners must choose this option: “I am qualified for the income-based PA tax forgiveness rate.” You must also select the correct year for which you are requesting a refund.

Philadelphia non-residents must download and complete this Excel spreadsheet. It will help you capture all the details required to process your refund request. You can easily upload the completed spreadsheet to the Philadelphia Tax Center by selecting “Add attachments.” This allows you to submit all your required documentation together.

Need a payment agreement?

Our new tax filing and payment website is designed to give you greater control over your accounts online. If you are behind on your taxes, a payment agreement will help you get back on track. You can submit a request online in just minutes – here’s how:

- Log into your Philadelphia Tax Center profile,

- Choose “More options” to access the “Payments and returns” tab in your dashboard. Then,

- Select “Request payment agreement.”

Here, you can pick a payment plan that fits your budget, set the first payment date, and make a down payment. Follow the on-screen prompts to complete the process.

If you haven’t yet created a username and password, please visit the Philadelphia Tax Center to do so now. You will need it to request a payment agreement online. Moreover, having a login broadens your ability to manage your accounts anytime, anywhere.

If you have trouble requesting a Wage Tax refund or payment agreement in the Philadelphia Tax Center, please call (215) 686-6600.

Photo credit: WOCinTech flickr