Starting on October 3, taxpayers must use the Philadelphia Tax Center to file and pay the following City taxes:

- Parking Tax

- Valet Parking Tax

- Hotel Tax

- Amusement Tax

- Mechanical Amusement Tax

- Vehicle Rental Tax

- Outdoor Advertising Tax

Previously, taxpayers did not need to file a return for these taxes. However, the taxes listed above can only be filed electronically after October 3. The short return for these self-assessed taxes will mimic the original coupons you previously used for payment.

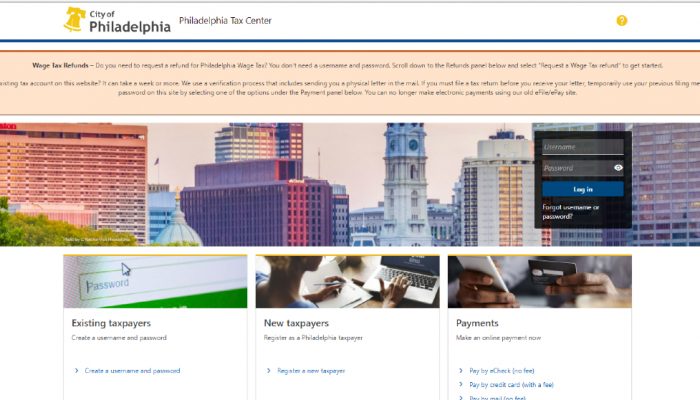

While you don’t need a username and password to pay taxes on the Philadelphia Tax Center, you must be logged in to file these returns. Keep in mind that paying these taxes online does not satisfy their electronic filing requirements. You will receive a non-filer notice if you only pay online and fail to file these returns electronically.

Adding all taxes

Real Estate Tax is among major taxes coming to the Philadelphia Tax Center in October. Like the property.phila.gov website, you can look up your property tax balances and pay your bills using the Tax Center starting on Monday, October 3.

We moved most business taxes to the Tax Center on November 1 last year, making it easier to file and pay them anytime, anywhere. This October, we will be adding the following taxes:

- Real Estate Tax

- Use and Occupancy Tax

- Realty Transfer Tax

- Hospital Tax

- Parking Tax

- Valet Parking Tax

- Hotel Tax

- Amusement Tax

- Coin-operated Tax (also known as Mechanical Amusement Tax)

- Vehicle Rental Tax

- Outdoor Advertising Tax

Once available on the Tax Center, you can access and pay these taxes online without logging into your Tax Center profile. Nevertheless, you must create a Philadelphia Tax Center username and password to meet the filing requirement for certain City taxes.

Assistance programs and more

The City’s also moving all of its major programs and fees to the Tax Center this fall. Starting on October 3, you must use the Tax Center to look up and pay Refuse Collection Fee (Commercial Trash Fee), Police Fees, and any outstanding Licenses & Inspection abatement invoices. No username and password required to access these services online.

Qualifying Philadelphians should also use the Tax Center to apply for the Homestead Exemption, Owner-occupied Real Estate Tax Payment Agreement (OOPA), Longtime Owner Occupants Program (LOOP), Senior Citizen Tax Freeze, Active Duty Tax Credit, and Refuse Exemption.

You don’t need a username and password to complete and submit your application to these programs online.

Similarly, Philly employers and payroll companies can use their City tax ID and PIN to download bulk Wage Tax reports from the Tax Center.

Individuals and businesses needing City Tax Clearance can submit their requests through the Tax Center without creating a username and password. The system will also allow residents to request and pay for police resources without creating a username and password.