If you’re a Philadelphia taxpayer, you already know that the City’s new tax website is the quickest, most convenient way to pay taxes. The Philadelphia Tax Center allows you to pay your bills as a guest!

There’s no need to log into an account or create a username and password before paying a bill. All you need is your FEIN, SSN, or Philadelphia tax ID number (PHTIN) to make payments. You can also use your Individual Taxpayer Identification Number (ITIN) or the Letter ID on the payment voucher portion of the bill you received.

This is a huge relief for taxpayers who don’t have Philly tax accounts but need to make quick bill payments online. The system also allows third-party tax professionals to make non-logged in payments on behalf of their clients.

Here’s how to get started:

- Go to https://tax-services.phila.gov

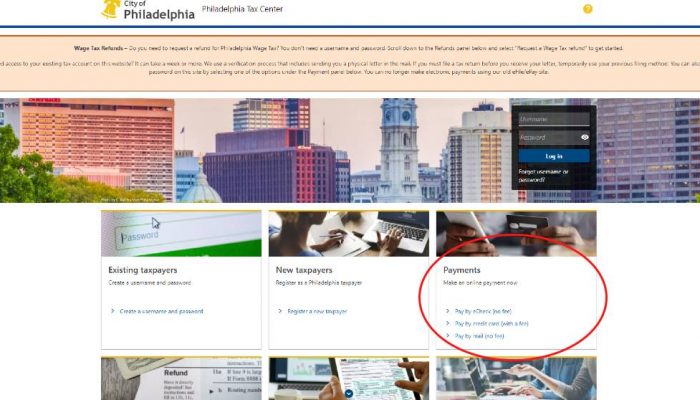

- Find the “Payments” panel on the homepage

- Pick your preferred payment method

- Follow the prompts to complete and submit your payment

Paying by eCheck is always free, but payments with a credit card come with a service fee.

If your bill or payment voucher is lost, you can easily print a copy on the Tax Center. Again, no username and password required. Just select “Pay by mail” from the Tax Center’s homepage, under the “Payments” panel.

Enter your preferred ID type (i.e., your FEIN, SSN, or Philadelphia tax ID) under “Taxpayer information” and select “Next.” Make sure the ID type you pick matches our records. If you need help, please call (215) 686-6600.

The Philadelphia Tax Center allows you to securely manage your tax accounts online, go paperless, and communicate with the Department of Revenue from your account.