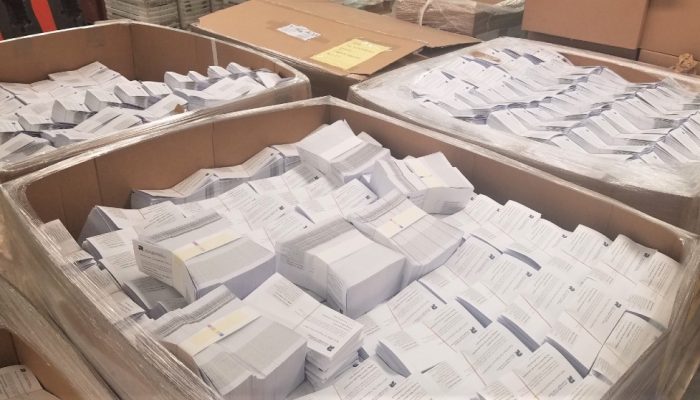

The Department of Revenue recently mailed Real Estate Tax bills to nearly 350,000 Philadelphia property owners. Keep an eye on your mailbox and make sure to pay on time to avoid accruing interest and penalties.

Property tax payments provide revenue that supports local schools, parks, police, and fire departments, among other essential City services.

Deadline

The 2023 bills are due March 31, but don’t wait for the deadline to pay. Paying on time or earlier prevents your bill amount from increasing and helps you avoid missing deadlines.

How to pay

- Online – you can view your balance and pay your bills on the Philadelphia Tax Center. Searching and paying your bills on the Philadelphia Tax Center is fast, secure, and easy. The best part? You don’t even need to create a username and password to access your bill on this website. The Philadelphia Tax Center is now the City’s official tax filing and payment website. Customers who own or manage multiple properties should consider creating a username and password. This way, you can see all balances on your properties without switching accounts.

- Over the phone at no extra charge. Just call (833) 913-0795 and be ready to share your bank account and routing numbers.

- In person– we recommend making an appointment before coming to the Municipal Services Building in center city, across from City Hall.

- By mail – remember to always include your payment voucher with your check. Send your payment to:

Philadelphia Dept. of Revenue

P.O. Box 8409

Philadelphia, PA 19101-8409

Can’t find your bill?

It is possible your bill may be delayed, derailed, or lost. Nevertheless, you must still pay your Philadelphia Real Estate Tax even if you don’t receive a printed bill. You can easily find your property tax balance on the Philadelphia Tax Center without creating a username and password. Just search your property using the “Property” panel on the site’s homepage and follow the prompts to find your property and pay any pending balances. You can pay online, or print a new payment voucher. Remember, not paying your bill on time can result in extra fees, a lien on your property, and even its sale.

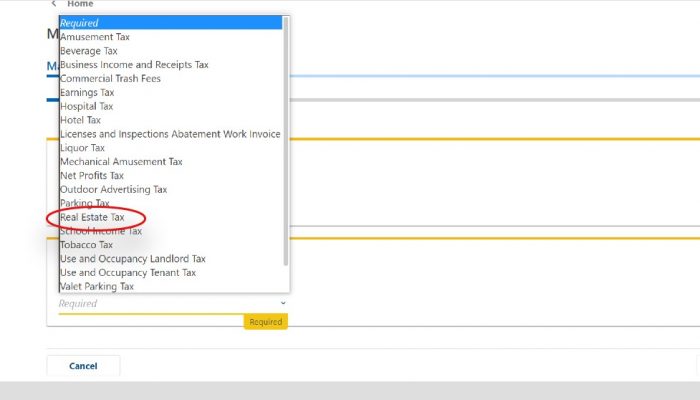

You can access your bill through the “Make a payment” link on the Philadelphia Tax Center’s homepage. You will be prompted either pick “Yes” or “No” to proceed. If you are paying a current year’s bill: Choose “Yes” and enter the Letter ID found at the top of your bill. Choose “No” on this same screen to pay past due bills and select “Real Estate Tax” from the dropdown menu. Follow the prompts to view, print, and pay your balance. Paying with eCheck is always free of processing charges. Credit card payments come with a service fee.

If you can’t pay your bill

Paying your bill in full is always best, but help is available. Apply for a payment agreement on the Philadelphia Tax Center, or call (215)686-6442.

If you have bill-related questions or need help, please call us at (215) 686-6442 or email us at revenue@phila.gov.

Photo credit: M. Bailey