As any accountant knows, juggling multiple clients and personal accounts can be overwhelming. Good thing the Philadelphia Tax Center streamlines your activities—helping you save time and stay on top of your workload. Whether filing returns, requesting refunds, or applying for tax credits on a client’s behalf, the system lets you do it all from a single dashboard!

You only need one username and password to access and manage all client—and your own—accounts. That way, you can switch from one account to the other without signing in and out.

Access with ease

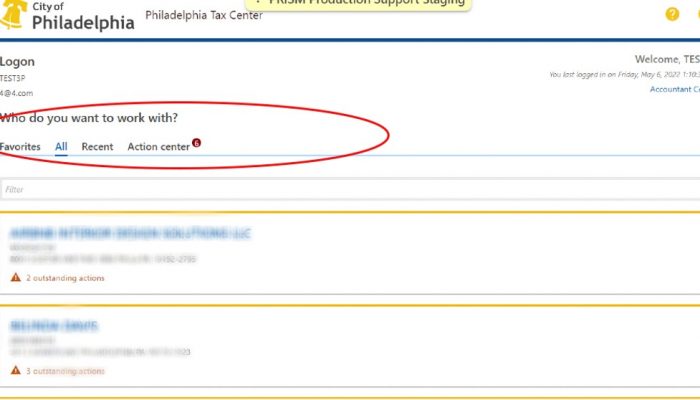

Once logged in, the system lets you take control of your tasks from a single screen containing an “All,” “Recent,” and “Favorites” tab.

The “All” tab groups your client accounts alphabetically, making it easier for you to navigate them. The “Favorites” tab lets you return to your most frequently accessed accounts in no time.

Generally, the system allows you to view letters, request access to new accounts, or file returns on behalf of multiple clients without logging out and back in.

If your clients have existing accounts

You can access existing clients’ accounts on the Tax Center, but you must first create a username and password to request a verification letter from us. We will send a physical letter in the mail to your client’s address on file. It will arrive five to ten days later. This is a one-time process intended to safeguard your client’s tax information. To request a verification letter:

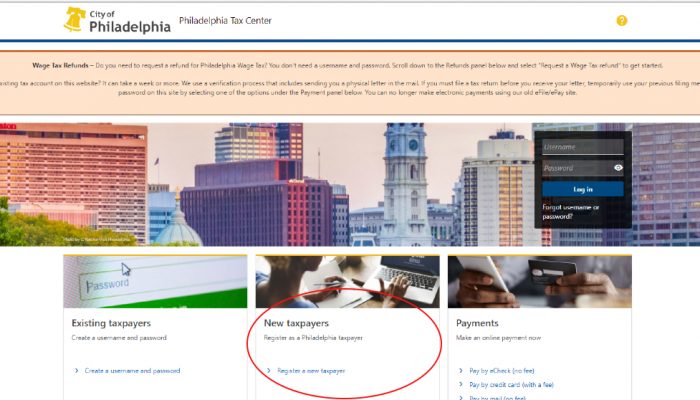

- Go to https://tax-services.phila.gov, select “Create a username and Password” under the “Existing taxpayers” panel on the homepage, and pick “Yes” when asked, “Are you a third-party tax professional?”.

- The system prompts you to set up two-step authentication before accessing the “Accountant center” link in the far-right corner of the screen.

- Under the “Third-party access” panel, select “Request taxpayer access” and enter your client’s FEIN or SSN and their full name. Make sure the name and number match our records.

- On the next screen, pick your client’s tax types, select “Next,” and follow the on-screen prompts to complete the process.

When you select “submit,” we send a letter to your client’s address on file. Once the client receives the letter, they can share the Letter ID with you. Then, return to the Tax Center’s homepage, use your username and password, and two-step authentication to log back in.

Find the “Accountant center” link, select the “Third-party access” panel, pick “Verify taxpayer’s access,” and enter the Letter ID your client shared with you—this unlocks your access!

Make sure your client’s mailing address in our records is correct. If it is wrong, they will not receive the letter you need to complete this process. Call (215) 686-6600 if you need to update their address.

When your client is a new Philly taxpayer

You will still need to request a verification letter: from the Tax Center’s homepage, select “Register a new taxpayer.” Under “Registration type,” the system asks, “Are you a third-party tax professional registration on behalf of your client?” select “Yes.”

Enter your client’s mailing address, name, entity, tax type(s), and ID information. Follow the on-screen directions to complete the process. Then return to the homepage to request the verification letter.

You can always pay your client’s bills online without logging in. Just select a payment option under the “Payments” panel on the Tax Center’s homepage. You will need their SSN, FEIN or Philadelphia tax ID to complete this process.