Still haven’t filed your Business Income & Receipts Tax (BIRT), Net Profits Tax (NPT), School Income Tax (SIT), and Earnings Tax returns? You have until April 18 to file and pay these Philadelphia taxes. This due date change aligns with the IRS deadline—moving this year’s Tax Day from the original April 15 deadline to April 18.

You will not owe interest or penalties on BIRT, SIT, Earnings Tax, and NPT for Tax Year 2021 if you pay your tax liability in full by April 18, 2022. Remember, there are no extensions for payment of taxes. Payments made after their due dates incur extra charges. So don’t miss the April 18 deadline.

File and pay online

Philadelphia residents who received a distribution from stocks, bonds, or other investments in 2021 must file and pay the 3.8398% School Income Tax. At the same time, anyone conducting business activities in Philadelphia must file and pay the BIRT and, if your business is not incorporated, also file and pay the NPT.

You can securely file and pay all four taxes online—Earnings Tax filers now have the option to file their returns electronically:

- Log into your Philadelphia Tax Center profile,

- Scroll to the summary subtab and find your BIRT, NPT, Earnings Tax, or SIT account

- To the right, select “File, view, or amend returns”

- Follow the on-screen prompts to submit your returns

You can always pay online without a username and password, but you will need them to access your tax accounts and file your returns electronically. If you don’t have a username and password, please go to https://tax services.phila.gov to create them now. Our new tax filing and payment website is mobile-friendly and fully accessible in Spanish.

We encourage you to use the online forms to file your taxes to avoid processing delays. If you prefer filing paper returns, you can find the 2021 BIRT, SIT, Earnings Tax, and NPT paper forms on our website.

A quick refresher

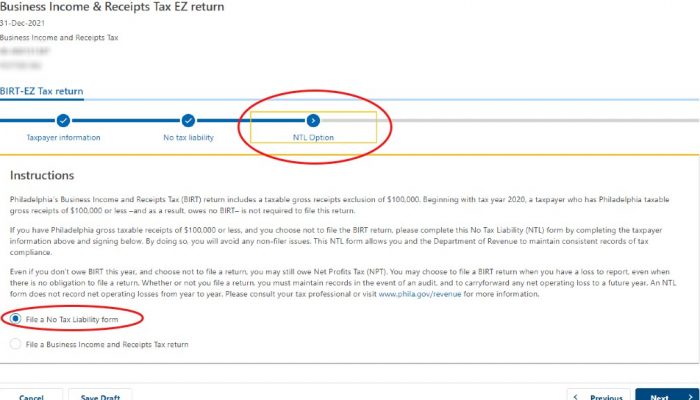

The current BIRT rate is 0.1415% on gross receipts and 6.20% on taxable net income. You don’t have to file a BIRT return if you have less than $100,000 in Philadelphia gross receipts for 2021. But you must file a No Tax Liability form to let the City know you don’t owe this tax. To do this:

- Go to https://tax-services.phila.gov

- Log into your profile

- Find your BIRT account and enter your tax liability for 2021.

- If it’s less than $100,000, the site will prompt you to file a No Tax Liability (NTL) form.

For Tax Year 2021, Philadelphia residents must pay 3.8398% of net profits for NPT. The non-resident rate is 3.4481%. The 2021 Earnings Tax rate for Philadelphia residents is 3.8398% and 3.4481% for non-residents.

Got filing questions or need help with your returns? Please email revenueaudit@phila.gov or call (215) 686-6500.

Photo credit: M. Bailey