The deadline for Philadelphia’s Homestead Exemption application is coming up again. If you are a Philly homeowner, you must apply fast to receive this property tax discount on your 2022 Real Estate Tax bill.

Unlike other City programs, Homestead doesn’t have open enrollment. You must apply by September 13 to start saving on next year’s property tax bill.

Homestead saves Philadelphia homeowners up to $629 each year. But many homeowners aren’t taking advantage of this recurring Real Estate Tax relief.

The program doesn’t have age or income requirements. If you own a home in Philadelphia and live in it as your primary residence, you qualify!

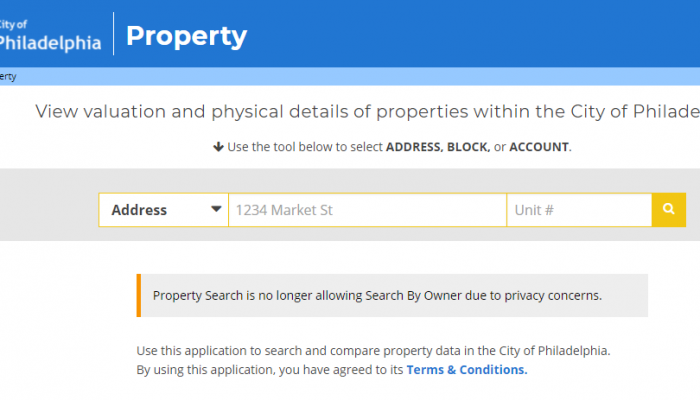

To see if you are enrolled, visit Property | phila.gov, type in your street number and name, and scroll down the page. On the right side of the screen, you will see the words Homestead Exemption.

If you have Homestead, you will see “YES” directly below the street map. In this case, you don’t have to reapply.

If you see “NO,” visit our website to learn more about the program, and how to apply. It only takes a one-time application. If approved, you will get the discount yearly. Only reapply if there is a change to your deed.

Ways to apply

Applying for Homestead is simple. You can sign up online by filling out the online Homestead Exemption application.

It is also easy to apply over the phone. Just call the Homestead hotline at (215) 686-9200, and one of our service representatives will gladly assist you.

In case you prefer to mail in your application, send your completed Homestead Exemption application to the address below:

City of Philadelphia

Department of Revenue

P.O. Box 52817

Philadelphia, PA 19115

Photo credit: Joseph Bamat