When trying to purchase or refinance a residential or commercial property, you might discover there is a lien or judgement on the property. A lien is a legal claim against a property because of a debt owed. A lien can come from different kinds of debt, such as:

- Property tax,

- Business tax,

- Water bills,

- Trash and pest removal performed by the City,

- As well as other debt.

Before the sale or refinancing can go through, the lien or judgement must be paid off first. Usually title companies –but sometimes individuals– do this by submitting a payoff request to the City.

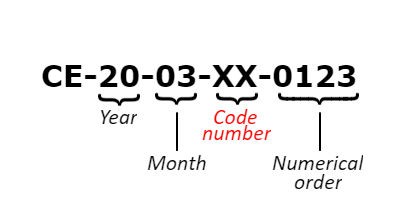

Each judgment against a person, or lien against a property, is given a docket number by a court of law. To request a payoff, it’s helpful to understand this number. The number contains information about:

- The type of judgment/lien that exists, and

- What City agency or department to contact for your payoff request.

You’ll need to provide the entire docket number when submitting a payoff request. We’ve provided some information on how to “crack the code” of docket numbers, and who to contact based on the code.

Each set of numbers in the code can help you to identify exactly which City department you’ll need to contact. Take a look at the code enforcement number below for a case filed in March of this year:

- 20 represents the year 2020,

- 03 represents the month of March,

- XX represents the Code number, and

- 0123 is the numerical order assigned by the court.

We’ve created a table on our website, that allows you to match code numbers to the City agency or department that will handle your lien or judgement payoff request. The table provides contact information to resolve many kinds of cases.

Most judgments and liens are filed in the Court of Common Pleas (“CCP”) and do not have code numbers. Instead, you’ll see a nine digit number on the docket. You can learn more about the different parts of a Municipal Court Code Enforcement docket number on our website.

Note: Real Estate Tax delinquencies have a 15-digit lien number containing the capital letter “R” for every individual tax year. For more information about Real Estate Tax lien numbers, see our Real Estate Tax balance website. However, if the City sends your account to a collection agency, you will need to contact that agency to resolve the outstanding balance.

Photo Credit: Elena Iwata