Philadelphia’s Department of Revenue publishes periodic reports on tax and water bill collections, delinquencies, and other analyses. Reports are released on a monthly, quarterly, and fiscal year basis. They assist in tracking revenue collections, delinquency changes, and understanding various industries’ performance. They’re also a great tool for revenue projections. Keep reading to discover more.

A quick overview

The Department of Revenue collects revenue owed to the City and School District of Philadelphia. We also administer tax and water assistance programs.

We compile and publish periodic reports about these activities. The goal is to help decision-makers understand how and where the City generates revenue. Reports provide statistical information about collections, tax and water delinquencies, assistance programs, and more. The data use in our reports comes mostly from Revenue’s integrated tax system and the City’s financial system.

Here’s what you can expect

We use statistical tables, charts, graphs, and concise narratives to make our reports easy to read and understand. Each report has its own insights:

- Some track collections over time.

- Some focus on assistance programs.

- Others look at specific tax types and show which industries contribute the most and how those contributions change over time.

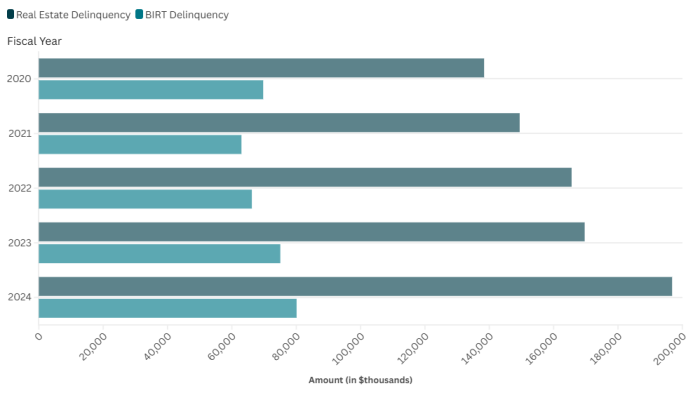

- Others show tax and water delinquencies, broken down by tax or installation type. Researchers and urban economists will find this data helpful.

- There are also narrative reports that explain trends and operational impacts based on the underlying data.

For example, a monthly collection report shows how much revenue was collected for that month. It compares what’s been collected with what’s been estimated from the annual budget submitted by the Office of the Director of Finance. It also shows the Department of Revenue’s performance against budget estimates for each tax type and for the various funds these taxes contribute to (e.g., General Fund, School District).

An industry analysis report digs deeper into a specific tax type, like the Business Income and Receipts Tax (BIRT). This type of report shows how much BIRT payment is collected per industry, per year.

Where to find our reports?

Visit the following websites to view or print our reports. You can also download them for easy sorting, analysis, and visualization:

- The Department of Revenue’s website,

- Philly Stat 360 Hub, and

- OpenDataPhilly – here, you’ll also find data on properties with tax delinquencies. These open datasets include principal due, interest, penalty, and outstanding balances. They’re aggregated by zip code, census tract, and council district. Keep in mind that a Philly property tax account is delinquent if Real Estate Tax isn’t paid by January 1 the following year after the tax was due.