Philadelphia’s Use & Occupancy (U&O) Tax filers now have the option to file their returns annually. Currently, businesses operating in the City must file and pay the U&O Tax on the 25th of each month. Often this tax is part of a rental lease, but not always. If you are a property owner of a business that pays U&O, you can avoid a repeat of this task 12 times a year by switching to annual filings today.

Last year, hundreds of taxpayers filed and paid for the entire year at once, saving them time and energy. Annual filers have the option to amend their returns and switch filing frequencies as needed. Even better, skipping the monthly deadlines helps you avoid incurring interest and penalties for late or missed monthly filing and payment.

If you participated in our annual Use & Occupancy program last year, you must still confirm you participation in annual filing for this year. Current participants must renew their annual filing preference every year to remain active in the program.

For new businesses wishing to join

You can easily switch your filing and payment frequency online. The process is fast and secure, but you must meet the following requirements:

- Have a Use & Occupancy account with us.

- Make sure all prior year returns were filed on time (December through November)

- Have no posted returns or payments for the next tax year (January or later)

- Must not have reported any vacancy, delinquent tenants, or tax credits for the prior year (December – November timeframe)

Here’s how to switch

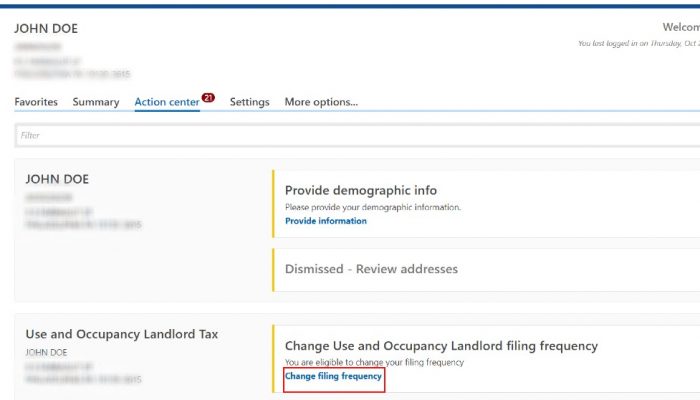

If you meet the criteria listed above, the option to switch your filing frequency automatically appears under your “Action Center” tab in the Philadelphia Tax Center. Be aware that you won’t see the “Change filing frequency” link if you don’t meet these requirements. To switch:

- Log into your Philadelphia Tax Center profile.

- Under the “Action Center” tab, find your Use and Occupancy Tax panel, and select “Change filing frequency.”

- Review and select “Submit.”

You can also access your Use and Occupancy panel from the “Summary” tab on your dashboard. Select “Action Center Items” to see all action center items for Use and Occupancy only.

Once you submit, your account will be set to annual filings. Make sure to file your returns between January 1 and January 26.

Keep in mind

The annual filing and payment window is closing quickly. You must switch by January 25, 2023, to participate in this year’s program. If you change your mind before filing your annual returns, you can use the steps referenced above to switch back to monthly filings. Should you change your mind after filing your annual returns, you must call (215) 686-6600 to help you change your frequency back to monthly.

If you change your filing frequency this year, you automatically qualify for annual filing and payment next year but must opt for annual filing (each year) to continue participating in the program. Again, current participants must opt for annual filing (yearly) to maintain this filing frequency.

Please be aware that if you file annually, you can only claim an exclusion for residential use. You must switch to monthly filing to claim other exclusions such as vacancy, delinquent tenants, or tax credits.