Curious to know why you must get a verification letter from us before accessing your tax accounts on the Philadelphia Tax Center? One answer: it helps us keep your personal and tax information safe.

The verification process is only for existing Philadelphia taxpayers. You must verify your identity to be granted access to your accounts if using the Tax Center for the first time.

This one-time process ensures that only you and those you allow can access your confidential tax information. For example, a third-party tax professional managing your accounts will only have access to your information if you allow them.

If you’re a new taxpayer registering through the Philadelphia Tax Center, you don’t have to go through this process.

Request a verification letter

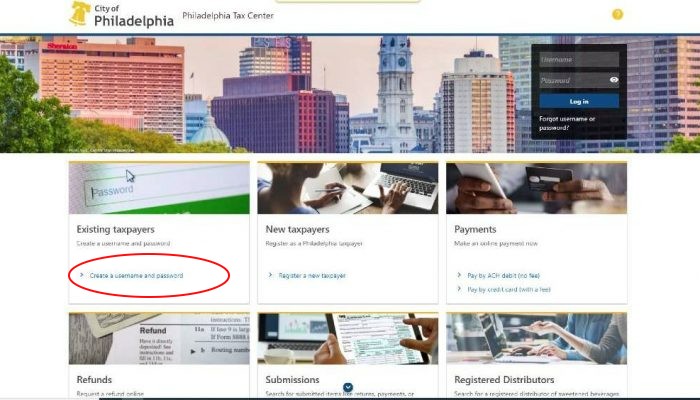

Existing taxpayers must first create a username and password to request a verification letter—it’s a two-step process:

- Select “create a username and password” from the Tax Center’s homepage, under the “Existing taxpayers” panel. Enter your entity ID that matches our records—this could be your EIN or Individual Taxpayer Identification Number (ITIN). You can also use your Social Security Number. Follow the on-screen prompts to finish the process.

- Then, navigate back to the home screen and enter the username and password you just created. The site prompts you to set up two-step authentication. This is an added security layer to further protect your information.

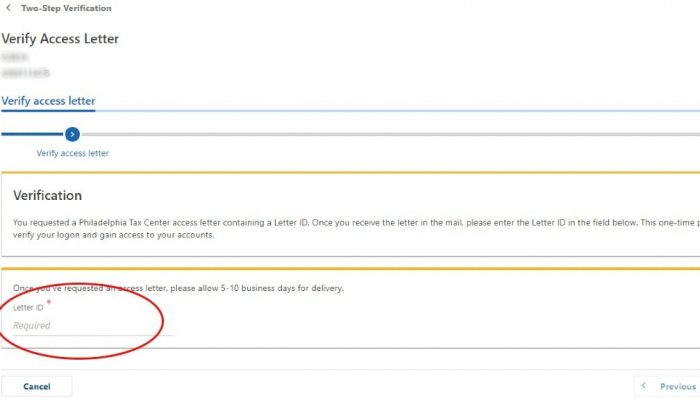

The “Request access letter” screen will only appear after completing this step. Once you select “Submit,” we send a physical letter to your address on file.

Check your mailbox

The letter comes in the mail five to ten days later. It contains a one-time Letter ID that’s unique to you. Log back into the Tax Center and enter the Letter ID to complete the verification process. This unlocks your tax information—giving you greater control over your accounts online!

You will receive a letter if a third-party tax professional requests access to your accounts. You can grant their request by giving them your Letter ID.

Make sure your mailing address on file is up-to-date. If your address is wrong, you will not receive the verification letter. You will also be unable to access your tax accounts on the Philadelphia Tax Center. If you need to update your address, please call (215) 686-6600.

Third-party access

Third-party tax professionals don’t need separate usernames and passwords for each clients’ accounts. You can manage multiple accounts, including yours, under one username and password.

Select “Create a username and password” from the Tax Center’s homepage, and pick “Yes” when asked, “Are you a third-party tax professional?”.

After completing this step, select the “Accountant Center” link. Find the “Third Party Access” panel and pick “Request taxpayer access.”

The Philadelphia Tax Center is designed to simplify your online tax filing and payment experience. It is mobile-friendly and fully accessible in Spanish!