Are you a Philadelphia homeowner? You probably qualify for property tax relief through the City’s Homestead Exemption program. Tens of thousands of eligible homeowners are already taking advantage of this program, saving up to $629 every year. You can too.

To see if you have Homestead, visit Property | phila.gov, type in your address (enter street number and name) and scroll down the page.

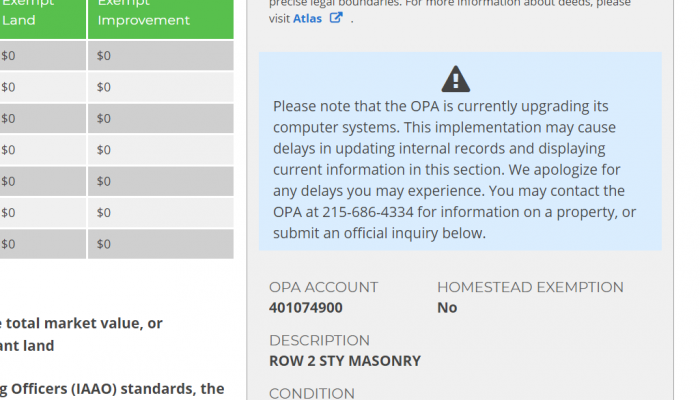

To your right, you will see Homestead Exemption and your property’s status. If your property is already enrolled, the status will be “yes” and “no” if you are yet to sign up for the program.

If you don’t have Homestead, visit our website to find out how to apply and learn more about the program. You could start saving on next year’s property tax bill, but you have to apply by December 1.

To apply, you must:

- Own a property in Philadelphia, and

- Live in the property as your primary residence.

Having a mortgage or being delinquent on your taxes does not affect your eligibility. However, you are not qualified for Homestead if your property currently has a 10-year tax abatement.

Many ways to apply

Enrolling in Homestead is simple. All it takes is a one-time application. If approved, you never have to reapply, unless there is a change to your deed. Your yearly property tax savings will remain in place as long as you continue to own and live in the property.

You may choose to apply:

- Online, by filling out the online Homestead Exemption application.

- By phone, by calling the Homestead hotline at (215) 686-9200,

- By mail, by printing out and completing the Homestead Exemption application.

Send your paper application to:

City of Philadelphia

Department of Revenue

P.O. Box 52817

Philadelphia, PA 19115