UPDATE (November 2, 2021): The City’s new tax filing and payment website, the Philadelphia Tax Center, is now live. From now on, please complete online returns and payments for most City business taxes on the new website. Check out our online tax center guide for help getting started and answers to common questions.

Instead of filing a full Business Income & Receipts Tax return, many small- and medium-sized businesses in Philly can now submit an annual No Tax Liability (NTL) form.

Businesses that have $100,000 – or less – in Philadelphia taxable gross receipts, don’t owe the Business Income & Receipts Tax (BIRT). But in the past, even if you did not owe BIRT, you still had to file a return.

Submitting our new NTL form allows your business to fulfill its tax-filing obligation, with almost no paperwork involved.

Completing an NTL form is fast, and will put a quick stop to receiving non-filer notices.

Go online

You can submit an NTL form online or by mail.

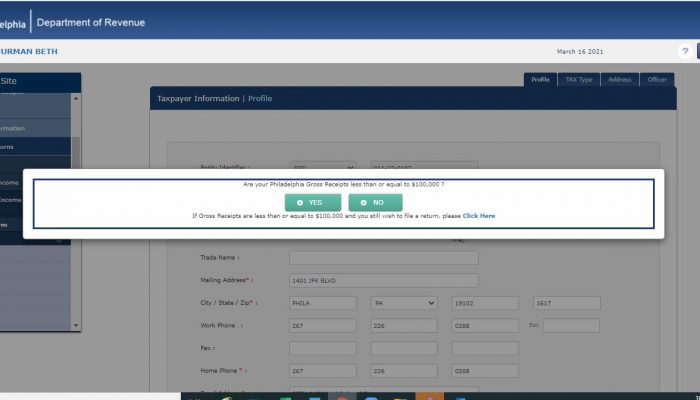

To submit online, log into your account on the City’s eFile / ePay website. Select “Electronic Returns” from the menu on the left, “EZ Form” and then “2020.”

A pop-up box will ask you if your Philadelphia Gross Receipts are equal to or less than $100,000. By selecting “YES,” you can submit a No Tax Liability form. Please note that you may still have to file and pay Net Profits Tax.

While online is the fastest and safest option, you can also submit an NTL form by mail. Find a paper NTL form on our website. Complete the form, then print and mail it to:

City of Philadelphia

Department of Revenue

P.O. Box 1660

Philadelphia, PA 19105-1660

Remember, you can use an NTL form ONLY when your business had $100,000 or less in Philadelphia taxable gross receipts. If you made more than that, you will have to file a BIRT EZ return, or a full BIRT return.

Right for you?

You can use an NTL form for your 2020 Business Income & Receipts Tax, and any year after that. For 2019 BIRT, and previous years, you must still fill out a BIRT EZ or full BIRT return.

Be aware that even if you don’t owe BIRT, it might still be smart for your business to file a BIRT return. For example, when you want to report a loss.

You must file a BIRT return to carryforward any net operating loss to a future year. An NTL form does not record net operating losses from year to year.

Also know that whether you decide to file an NTL or not, it’s your responsibility to maintain records in the event of an audit. We always recommend consulting a tax professional, who can help you decide what’s right for your business.