Homeownership offers a safe and stable place to live and a chance to build wealth over time. Homeowners tend to have lower monthly costs and may be less vulnerable to the short-term impacts of economic crises like the one caused by the Covid-19 pandemic.

Many cities – including Philadelphia – promote homeownership through first-time homebuyer programs. These programs make down payments and mortgages more accessible for low- and moderate-income households. In Philadelphia, the Philly First Home (PFH) program provides grants of up to $10,000 to help first-time home buyers with a down payment and other purchase costs.

Who is eligible for Philly First Home?

Households are eligible if they earn under 120% of the area median income (AMI). That’s $116,000 for a 4-person household or $81,000 for a single person. They cannot have owned a home in Philadelphia in the prior three years.

Who participates in Philly First Home?

- Around 2,000 households participated in the program between the start of the program in June 2019 and July 2020.

- 58% of participants are Black, 19% white, 3% are Asian and 17% are of more than one race. Around a quarter of participants are Hispanic.

- The largest group of participants have moderate incomes, earning between 50-80% AMI.

- The average home purchase price was $175,000.

Where do Philly First Home participants come from?

Most participants already lived in Philadelphia. Many stayed close to home, moving within the same neighborhood or even within walking distance. Only 4% of participants moved from outside of Philadelphia, and those few who did moved from inner ring suburbs.

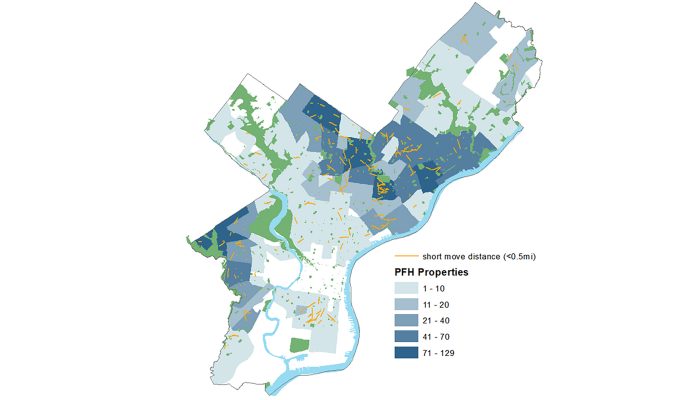

Only 20% moved more than five miles from their previous address. Short distance moves were most common in South Philadelphia, as well as the lower Northeast.

Where did participants move to?

More than half moved to an area with a similar housing market as the one they left. In most cases, these were “middle neighborhoods” like Olney, Oxford Circle, and West Oak Lane. More than 90% of participants bought in a neighborhood where there was little risk of displacing existing residents.

The majority of Black PFH participants moved to predominately Black areas (those where Black residents make up over 75% of the population). A similar trend, although less pronounced, could be seen with Hispanic participants. White participants, on the other hand, were just as likely to move to predominately non-white neighborhoods as they were to move to predominately white ones. However, many of the most popular neighborhoods for PFH participants were popular across racial and ethnic groups, particularly Juniata Park and Wissinoming.

PFH participants have similar incomes to their new homeowner neighbors. Half of participants moved to areas with a median homeowner income higher than their own; half moved to areas with lower median incomes.

The Philly First Home bottom line

Philly First Home gives non-homeowners the chance to buy a first home, to stay near their support networks, and to start to build wealth through homeownership. It also helps to stabilize neighborhoods, as participants tend to buy homes near where they lived before. Even when they moved farther away, they landed in neighborhoods like the ones they left.