UPDATE (November 2, 2021): The City’s new tax filing and payment website, the Philadelphia Tax Center, is now live. From now on, please complete online returns and payments for most City business taxes on the new website. Check out our online tax center guide for help getting started and answers to common questions.

The Business Income & Receipts Tax (BIRT, est. 1985) and the Net Profits Tax (NPT, est. 1939) are two of the major business taxes in the City of Philadelphia. They are part of a unique tax structure, which can sometimes confuse business owners and self-employed individuals. This summary aims to clear up some of that confusion by covering:

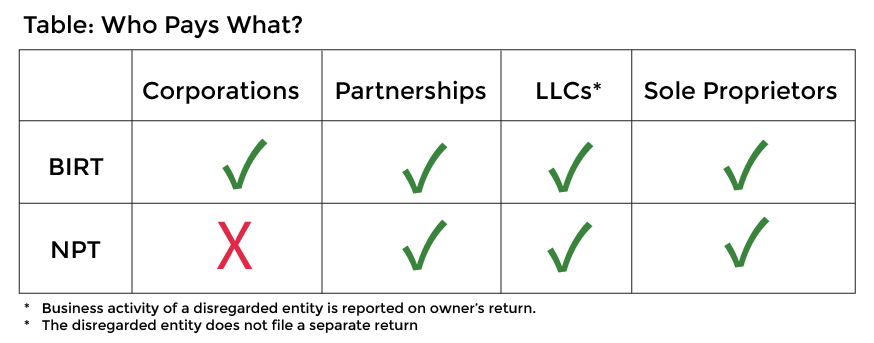

- Who pays each tax.

- When and how much to pay.

Who pays each tax

BIRT

BIRT applies to every entity, including sole-proprietors, engaged in a business for profit in the City of Philadelphia. This includes all businesses operating in the city, from large multinational corporations to local restaurants and retail shops.

There are two components of the BIRT:

- Tax on Net Income, which is based on the income a business generates in Philadelphia, and

- Tax on Gross Receipts, which is based on receipts from sales made and/or services performed in Philadelphia.

NPT

NPT applies to non-corporate entities only. This includes partnerships, LLCs, and also sole-proprietorships. If you’re a non-corporate consultant, freelancer or receive 1099 tax forms, you must file and pay NPT along with BIRT.

NPT is based on the net profits from the operation of a business.

It applies to:

- Philadelphia residents, even if all your business activity is conducted outside the city.

- The portion of profits earned by non-residents from business conducted in Philadelphia.

To provide relief from taxation of the same income, a taxpayer subject to NPT is allowed a credit against the tax of up to 60% of what they paid on the Net Income portion of the BIRT.

When and how much to pay

BIRT

In general, if you are a business entity, you must file an annual BIRT return and pay the tax for the preceding tax year by April 15 of the current year. With this filing, an estimate of the current year’s BIRT must be paid in full.

Businesses that started in 2019 and after should consult with the Department of Revenue or their tax advisor about changes to BIRT estimated payments that apply to new businesses.

The first $100,000 of taxable Gross Receipts are excluded from BIRT. There is a corresponding reduction of the Net Income portion of the tax related to this exclusion.

If the $100,000 gross receipts exclusion reduces your businesses’ taxable receipts to zero, or below zero, April 15, 2020 will be the last time you are required to file a complete BIRT return.

Effective for tax years 2020 and thereafter, if filing electronically, a business will simply affirm it has no BIRT tax liability. A “No Tax Liability” form is also in development for businesses that still file a paper return. NOTE: It may be prudent to file a complete BIRT return even if you qualify for the filing exemption. Please consult with your tax advisor if you have any questions.

You can file your BIRT return electronically. Check the Department of Revenue’s website for current BIRT rates, because they are scheduled to decline.

NPT

If you are non-corporate entity, you must file an annual NPT return by April 15 of each year. Payments for the current year’s estimated tax are due in two installments: The first by April 15, and the second by June 15. Each payment must equal 25% of the prior year’s NPT.

You must file an NPT return regardless of whether you made a profit for the year.

You can file your NPT return electronically. Check the Department of Revenue’s website for current NPT rates.

If you have any further questions about the differences between BIRT and NPT or any other business taxes, please email revenue@phila.gov or call (215) 686-6600.

Photo credit: @urphillyfriend