Couldn’t beat the March 31 property tax payment deadline? Your 2023 bill is now considered “past due” and has already started accruing a 1.5% additional monthly cost. The best solution is to take care of this bill now—because if you don’t pay by December 31, your account will become delinquent on January 1, 2024. And at that point, the City can put a lien on your property and add costs that will further increase the size of your debt.

Paying in full is the easiest and quickest way to resolve your debt. But we understand that things happen. For that reason, please call us at (215) 686-6442 to see if you qualify for our Owner-Occupied Payment Agreement (OOPA) program. Don’t wait for your account to become delinquent before contacting us.

What you should know about the OOPA program

This real estate tax relief program provides you with a plan to pay your old and current property tax debts in monthly installments, but you must live in your Philly home to qualify. Best of all, no down payment is required.

Once accepted into the program, the City considers you to be in good tax standing while protecting your home from a Sheriff’s sale. But that’s not all; your monthly payment is based on your income and household size. Some homeowners even pay as low as $0 per month.

Nevertheless, you must maintain consistent payment to stay enrolled in OOPA. Be aware that a late or missed payment may end your participation in the program.

Here’s how to get started

You can sign up for OOPA anytime, and the best way to apply is online:

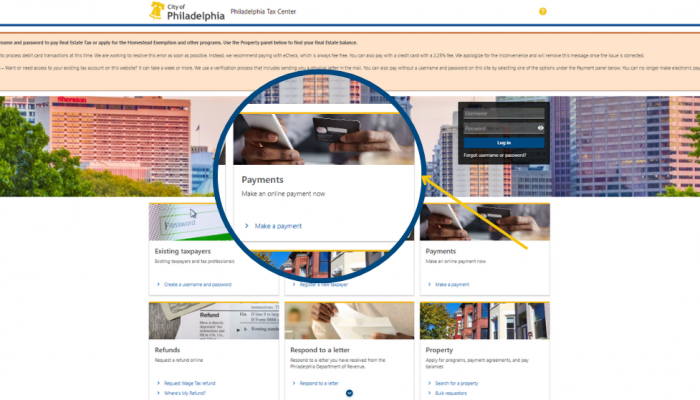

- Pick “Search for a property” under the “Property” panel on the Philadelphia Tax Center’s front page.

- Enter your address and hit “Search.” Your property’s OPA number appears as a blue hyperlink on the right side of the screen. Select it to access your property account.

- Select the “Apply for real estate assistance programs” link to access the next page. Choose “Submit an Owner-Occupied Payment Agreement” on this page and follow the prompts to submit your application.

If you need help or have questions, please call us at (215) 686-6442.

Making a payment?

If you’re ready to pay, go to the Philadelphia Tax Center and select “Make a payment” under the “Payments” panel on the site’s homepage. Remember, paying with an eCheck is always free of processing charges. You can also call (877) 309-3710 to pay your bill by phone or send a check with the payment voucher attached to your bill.