What we do

The Board of Ethics (BOE) administers and enforces the City’s public integrity laws.

We focus on:

- Financial disclosures.

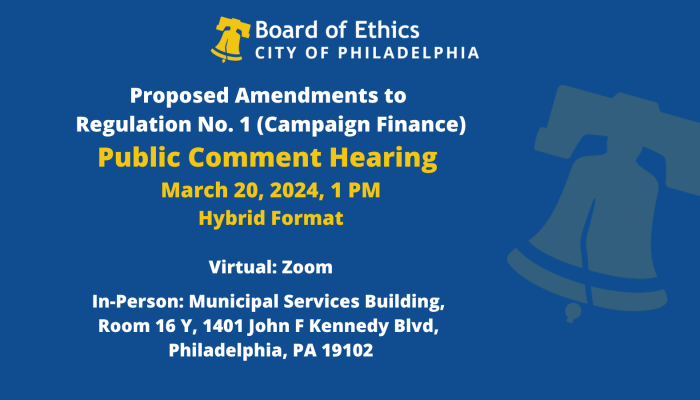

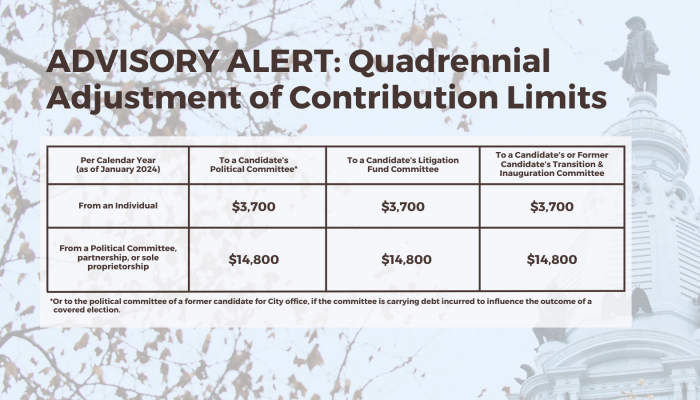

- Campaign finance rules.

- Lobbying.

- Gifts and gratuities.

- Conflicts of interest.

- Post-employment activities and representation.

- Political activity restrictions for City employees and officials.

BOE advises on possible ethics violations, educates others on rules and regulations, conducts investigations, and enforces ethics rules.

Formed in 2006, the independent, five-member board is appointed by the mayor and approved by City Council for five-year terms.

Connect

| Address |

1515 Arch St.

18th Floor Philadelphia, PA 19102 |

|---|---|

|

Phone:

(215) 686-9450

|

|

| Social |

Want ethics in your inbox?

Sign up for our newsletter and mailing lists.